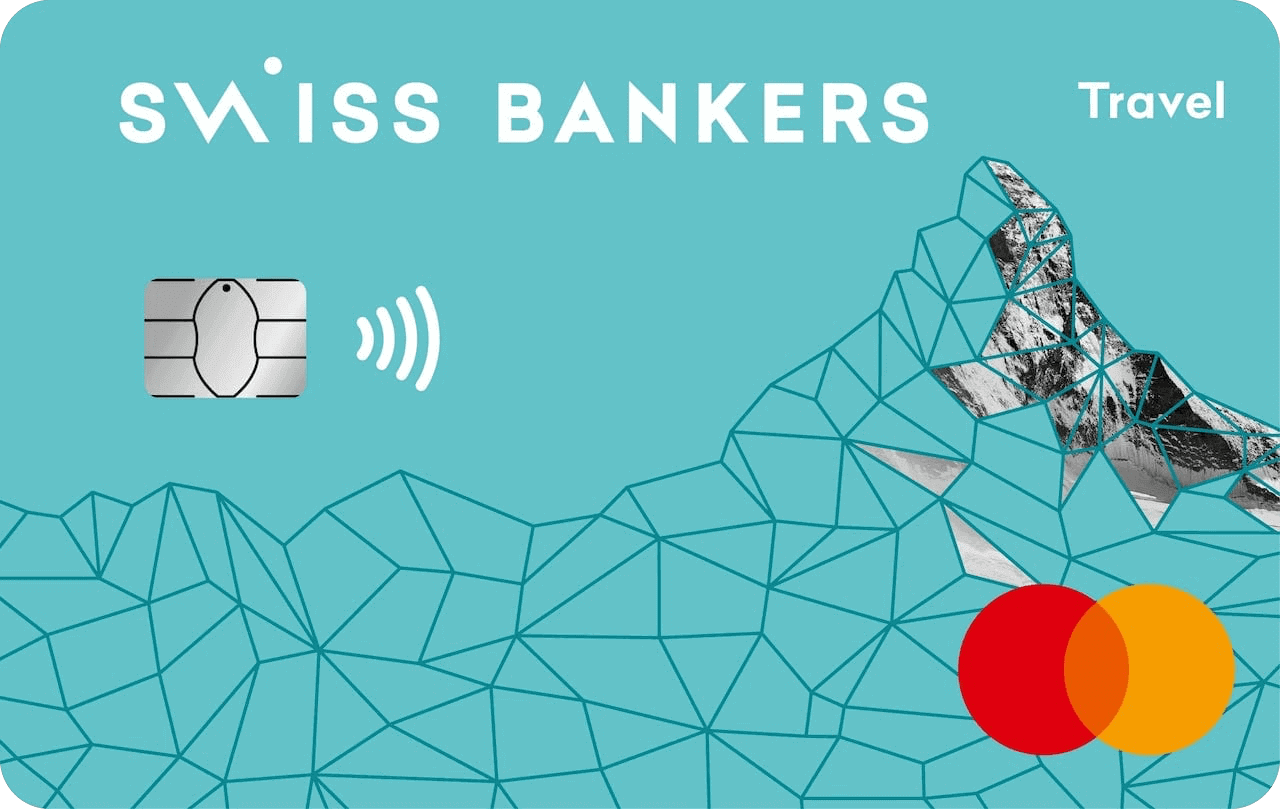

Life is the prepaid credit card from Swiss Bankers for everyday use. With our prepaid card, you alone determine what your budget is. You can add credit as needed, pay securely worldwide and always have your expenses and budget under control. Life is also available without plastic as the Life Digital mobile-only card.

Order Life Order Life DigitalLife Prepaid Card also available at over 200 outlets.

For all who always want to pay securely and contactlessly.

For all who pay digitally with their smartphone. Free of charge for 3 months.

Always safe: full cost control, flexible and risk-free payment.

You can use the prepaid Mastercard card in more than 70 million shops as well as for online payment. You can withdraw money at ATMs in Switzerland and abroad. If you have any questions, our free client service will be happy to assist you.

Life is available quickly and without a credit check from the Swiss Bankers online shop and various outlets – to all persons aged 16 and over.

You can add money to your card in amounts up to CHF 10’000 at the outlet, using the Swiss Bankers app, on our client portal or using e-banking.

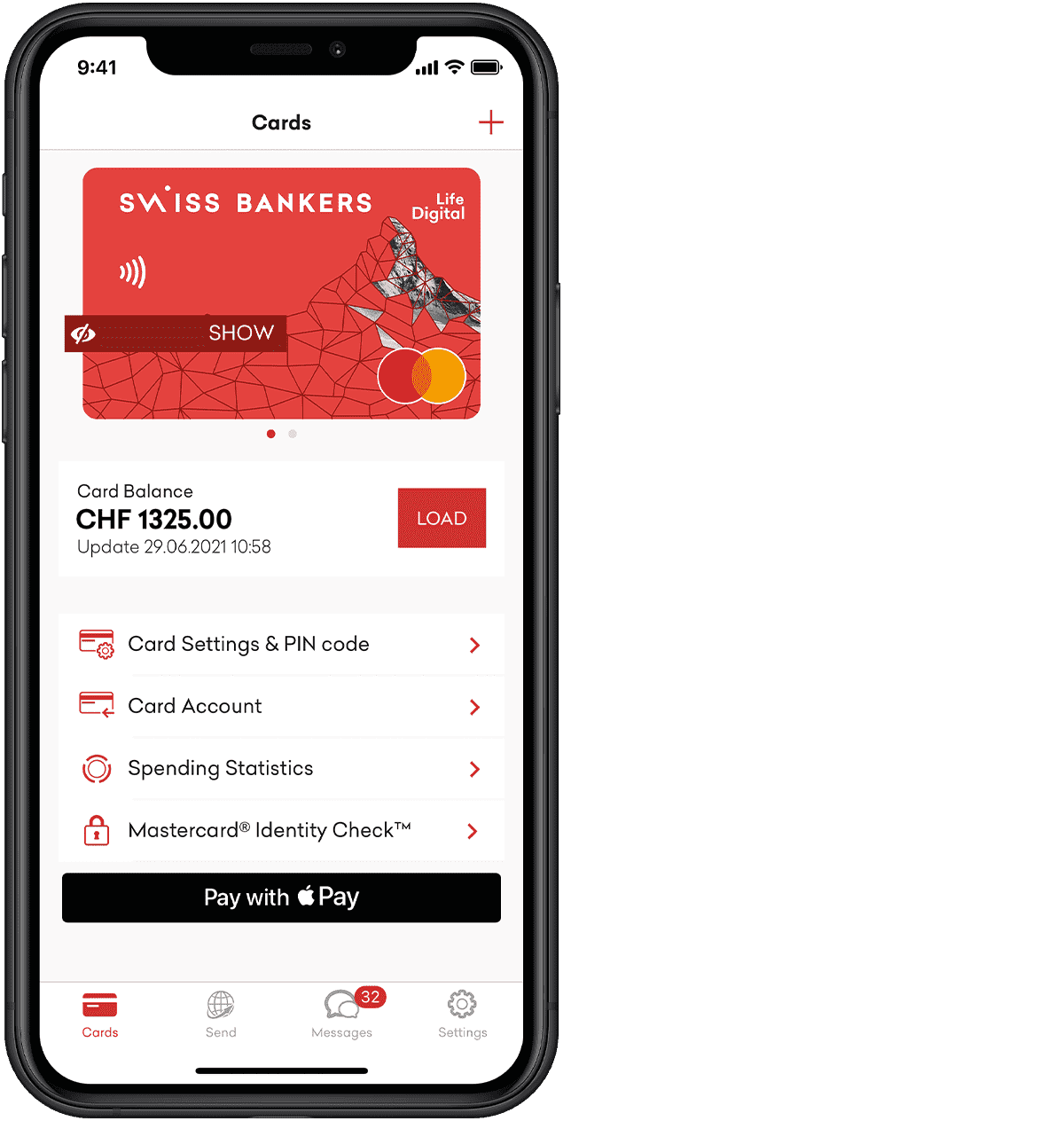

With Life and our Swiss Bankers app, you also benefit from mobile payments. You pay conveniently with your smartphone or your smartwatch, for example via Apple Pay or Samsung Pay.

The Swiss Bankers app includes practical features such as push notifications following every transaction, balance and spending overviews, adding money to the card balance, card blocking in the event of loss, and the option to replace digital or physical cards directly in the app – and much more.

The card can only be debited if a credit balance has been loaded onto it. You can challenge transactions within 30 days. The latest security standards provide security and protection against card misuse on the Internet. In the event of loss, the card including the balance will be replaced worldwide. You can only spend the amount you have loaded onto your card.

The latest security technologies protect against misuse. You can optionally block and reactivate your card for Internet purchases, contactless payment or certain countries.

Compare

Compare

Card fee

Annual fee: CHF 45

None

Annual fee: CHF 45

Monthly fee: CHF 2.90

None

None

Annual fee: CHF 45

Top-up fee

None, for cards obtained from Swiss Bankers

None, for cards obtained via outlets

Fast charge by credit card/debit card (approx. 15min): 1.5%.

Charge with PostFinance card: CHF 6.

Tip: It’s free to top up your card via online banking, and your credit is generally available in one working day1.

1.5%, for cards obtained from Swiss Bankers

1.5%1, for cards obtained via outlets

Fast charging by credit card/debit card (approx. 15min): Additional costs of 1.5% (on charging amount with charging fee).

Charging with PostFinance card: Additional costs of CHF 6.

Tip: When you top up your card via online banking, your credit is generally available in one working day. There are no further costs in addition to the top-up fee1.

None, for cards obtained from Swiss Bankers

None, for cards obtained via outlets

Fast charge by credit card/debit card (approx. 15min): 1.5%.

Charge with PostFinance card: CHF 6.

Tip: It’s free to top up your card via online banking, and your credit is generally available in one working day1.

None

Fast charge by credit card/debit card (approx. 15min): 1.5%.

Charge with PostFinance card: CHF 6.

Tip: It’s free to top up your card via online banking, and your credit is generally available in one working day.

1.5 %1

Fast charging by credit card/debit card (approx. 15min): Additional costs of 1.5% (on charging amount with charging fee).

Charging with PostFinance card: Additional costs of CHF 6.

Tip: When you top up your card via online banking, your credit is generally available in one working day. There are no further costs in addition to the top-up fee.

Subject to conditions1

None

Fast charge by credit card/debit card (approx. 15min): 1.5%.

Charge with PostFinance card: CHF 6.

Tip: Charge your card via e-banking (2-3 working days), so there are no additional costs.

Ways to top up your card

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

- Bank transfer/e-banking

- Credit card/debit card/PostFinance card

- Outlets

Tip: To find your personal payment details, open the Swiss Bankers app and select “Top-up.”

Charge per payment

None

CHF 1 / EUR 1 / USD 1

None

None

CHF 1 / EUR 1 / USD 1

None

None

Processing fee foreign country

0.95%

None

0.95%

0.95%

None

None

0.95%

ATM withdrawal fee in Switzerland

2%, min. CHF 2

2%, min. CHF/EUR/USD 2

2%, min. CHF 2

2%, min. CHF 2

2%, min. CHF 2

Subject to conditions

2%, min. CHF 2

ATM withdrawal fee abroad

2%, min. CHF 7.50

2%, min. CHF/EUR/USD 7.50

2%, min. CHF 7.50

2%, min. CHF 7.50

2%, min. CHF 7.50

Subject to conditions

2%, min. CHF 7.50

Replacement card

Replacement in case of loss or theft, including the remaining card balance, for a fee of CHF 20.00 in Switzerland and CHF 50.00 abroad. Replacement of digital cards within one working day.

Free replacement worldwide in case of loss or theft, usually within three working days, including the remaining card balance. Replacement of digital cards within one working day.

Replacement in case of loss or theft, including the remaining card balance, for a fee of CHF 20.00 in Switzerland and CHF 50.00 abroad. Replacement of digital cards within one working day.

Replacement of digital cards within one working day in case of loss or theft, including the remaining card balance, for a fee of CHF 20.00.

Free replacement worldwide in case of loss or theft, usually within three working days, including the remaining card balance. Replacement of digital cards within one working day.

Subject to conditions

Replacement in case of loss or theft including remaining card value for a fee of CHF 20.00 in Germany and CHF 50.00 outside Germany. Replacement of digital cards within one working day.

Card top-up

Min. CHF 100

Max. CHF 10 000

Min. CHF 100 / EUR 100 / USD 100

Max. CHF 10 000 / EUR 10 000 / USD 10 000

Min. CHF 100

Max. CHF 10 000

Min. CHF 100

Max. CHF 10 000

Min. CHF 100 / EUR 100 / USD 100

Max. CHF 20 000 / EUR 20 000 / USD 20 000

Subject to conditions

Min. CHF 100

Max. CHF 10 000

Card currencies

CHF

CHF / EUR / USD

CHF

CHF

CHF / EUR / USD

CHF / EUR / USD

CHF

Use options

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

- ATM

- Payment terminals / machines

- Contactless payment

- Internet / online payments

Mobile payment

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

- Apple Pay

- Samsung Pay

- Google Pay

- Garmin Pay, Fitbit Pay, SwatchPAY!

-

Availability

To the online shop, Banks, SBB

To the outlets

In CHF: To the online shop

In EUR / USD: To the outlets

To the online shop, Banks, SBB

To the outlets

Selected private banks

Maximum number of cards per person

One card directly from Swiss Bankers

Five cards via our outlets

Three cards directly from Swiss Bankers

Five cards via our outlets

One card directly from Swiss Bankers

Five cards via our outlets

1 card

5 cards

-

One card directly from Swiss Bankers

Five cards via our outlets

Swiss Bankers App Features

– Top up your card

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Top up your card

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Top up your card

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Top up your card

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Top up your card

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Block your card

– Geo-blocking

– Spending overview

– Many other features

– Block your card

– Geo-blocking

– Spending overview

– Many other features

1 Top-up fee may vary depending on the distribution partner

1 Top-up fee may vary depending on the distribution partner

Answers to general questions about PIN codes, security, mobile payment and services can be found under Frequently asked questions – general.

Where is the prepaid Life credit card available?

Life is available to all in the Swiss Bankers online shop, at 150 SBB train stations and from a number of banks. Please visit Outlets for a current list of distributors. By using voucher codes from campaigns, you will receive the first annual fee of CHF 45.00. Redeemable up to three months after publication.

Is there a minimum age for obtaining the card?

Life prepaid credit cards are issued to all customers:

aged 16 years and over, without an authorization

How does the digital card Life Digital work?

With our digital prepaid card, all payment information is stored on your smartphone. It works just like a normal mobile payment: simply activate the screen of your smartphone, hold it next to the payment terminal and complete the transaction.

What is a digital credit card?

A purely digital credit card is similar to a classic plastic card, but no physical card is produced. All the information of the digital card, i.e. card number, expiration date and card verification number (CVC), can be seen in the Swiss Bankers app. Basically, the only difference between a digital card and a physical card is that you can hold the latter in your hands.

Swiss Bankers offers the Life Digital, a digital prepaid credit card. You can order a Life Digital without a credit check within a few minutes and use it immediately after loading.

Why order a prepaid card from Swiss Bankers?

Swiss Bankers is the market leader for prepaid credit cards in Switzerland. With decades of experience, we are and will remain an innovation driver in the field of secure payment solutions. As one of the first providers in Switzerland, Swiss Bankers enables worldwide cashless money transfers to Mastercard cards. Swiss Bankers prepaid cards can be used digitally for mobile payments, with Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Swatch Pay and Fitbit Pay.

What are the advantages of a Mastercard prepaid credit card?

Prepaid credit cards from Swiss Bankers are based on Mastercard technology. Swiss Bankers uses the innovative and secure Mastercard payment system to offer you the latest payment features. In Switzerland alone, there are more than 100,000 acceptance points for our cards. Worldwide, there are over 70 million.

How long is my Mastercard card valid?

You can see the validity period on the card. As a rule, the cards are valid for three years after issuance. The credit will not be lost even if the validity expires. In this case you can transfer the balance to a new card.

Is the Life card also available as a digital credit card?

We offer the Life card in two forms: as a conventional plastic card or as a purely digital prepaid credit card, which you can order online here. For all those who often shop on the Internet and use mobile payments, Life Digital is the perfect choice.

What are the advantages of the digital Mastercard Life Digital from Swiss Bankers?

A purely digital prepaid credit card (or online credit card) cannot be physically stolen or lost. It therefore offers a particularly high level of security. Nevertheless, it is important to ensure maximum protection for the digital card with the numerous security features in the Swiss Bankers app.

Another advantage is that you can order and use the digital credit card online in just a few minutes. You don’t have to wait for delivery by the post office, as the card is immediately available on your smartphone. Via quick top-up using a credit card or PostFinance card, the Life Digital is loaded in no time and can be used immediately.

You can get the Life Digital card for CHF 2.90 per month.

Other advantages of the Swiss Bankers Life and Life Digital prepaid credit cards at a glance:

Who is a digital credit card suitable for?

A digital credit card is particularly suitable for those who often shop online and therefore do not need a physical card. You can also use it to pay in all stores that offer contactless payment. Withdrawing money is only possible at ATMs that support contactless NFC function. So far, only a few ATMs are equipped with it.

Who can apply for a Life or Life Digital prepaid credit card?

Anyone 16 years of age or older can apply for a Life prepaid credit card without a legal guardian. Persons 12 years of age and older require the authorisation of a legal representative.

Is a credit check performed?

Swiss Bankers only offers prepaid credit cards, therefore no credit check is required. Regardless of creditworthiness or an entry in the debt collection statement, anyone can apply for a prepaid card at Swiss Bankers. Likewise, no proof of regular income is required.

Applying for a prepaid credit card: What do I need?

To apply for a prepaid credit card, you need either a valid Swiss identity card or passport, or a valid residence permit for Switzerland. First you need to register with Swiss Bankers, then you will enter the order and identification process, where we will verify your information.

Can I apply for a credit card without a credit check?

You want to apply for a prepaid credit card at Swiss Bankers and you are not sure if a credit check is necessary? Swiss Bankers does not perform a credit check for the application for a prepaid credit card. Even if you do not have a sufficient credit rating, you will receive your prepaid credit card easily and quickly.

Can I use the credit card immediately if I order it online?

You can order and use the Life Digital from Swiss Bankers online in just a few minutes. If you load the Life Digital by credit card or PostFinance card, the credit will be available to you within a few minutes. If you load your Life Digital by bank transfer (via e-banking), it usually takes one working day to credit the card with the amount you have loaded: make the transfer in the morning and pay with the card in the afternoon.