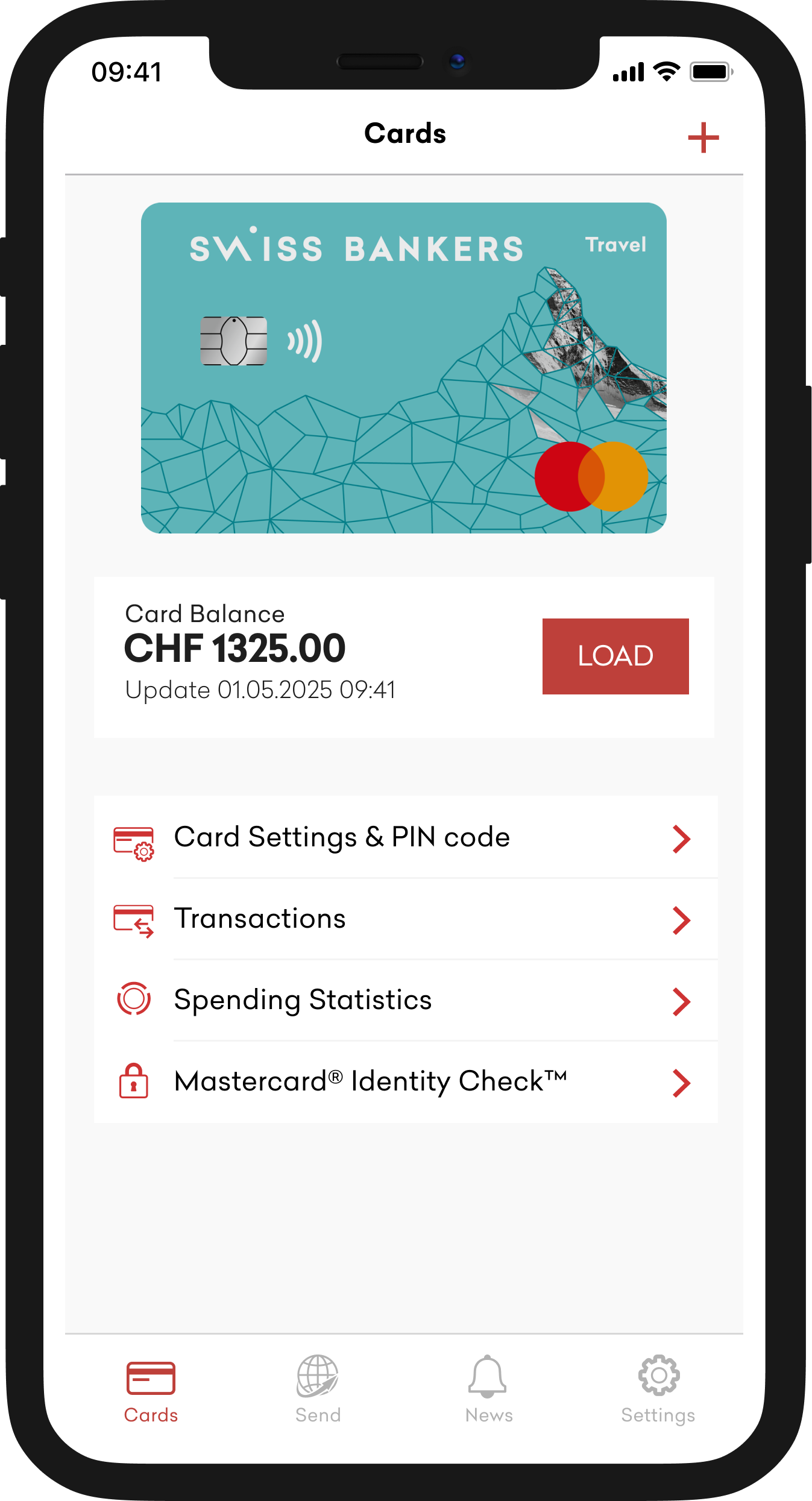

Adapted top-up options

Important information

We are delighted to have you here. We would like to inform you that Raiffeisen has discontinued sales of the Travel card. Don't worry, you can continue to use your Travel card.

- Your Travel card remains valid

- Your card terms and conditions remain unchanged

- Swiss Bankers will continue to sell the Travel card

- Customer support via Swiss Bankers remains guaranteed