Dear Customer, welcome to Swiss Bankers. From now on, we will be handling all matters concerning your Travel card (formerly known as Travel Cash), as PostFinance is no longer issuing this card.

Nothing will change for you – Swiss Bankers will remain your card issuer. All you have to do is identify yourself in the Swiss Bankers app. We will show you how and explain the various ways you will be able to top up your card in the future.

We are delighted that you have chosen to use the Travel card, a popular Swiss Bankers product, and would like to thank you for placing your trust in us.

As your card issuer, Swiss Bankers is now your main point of contact for all matters concerning your card. As such, we are legally required as a bank to confirm your identity. You can identify yourself using the Swiss Bankers app in a matter of minutes.

If you have not installed the Swiss Bankers app yet, you can download it for your smartphone from the Apple App Store or the Google Play Store.

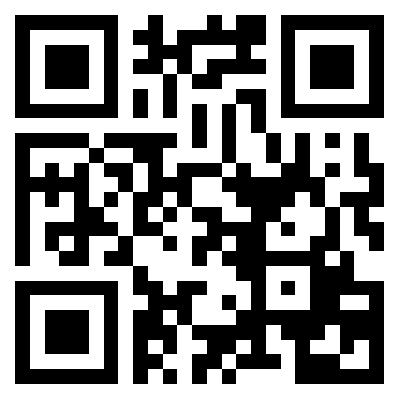

You can also scan the QR code or request a download link via SMS:

Select “Register” to log in using your mobile phone number.

If you have already registered, please log in.

If you have already added your Travel card, you will be taken straight to the identification step.

Sie können die Identifikation statt über die Swiss Bankers App per Post oder E-Mail durchführen:

Download the Swiss Bankers app

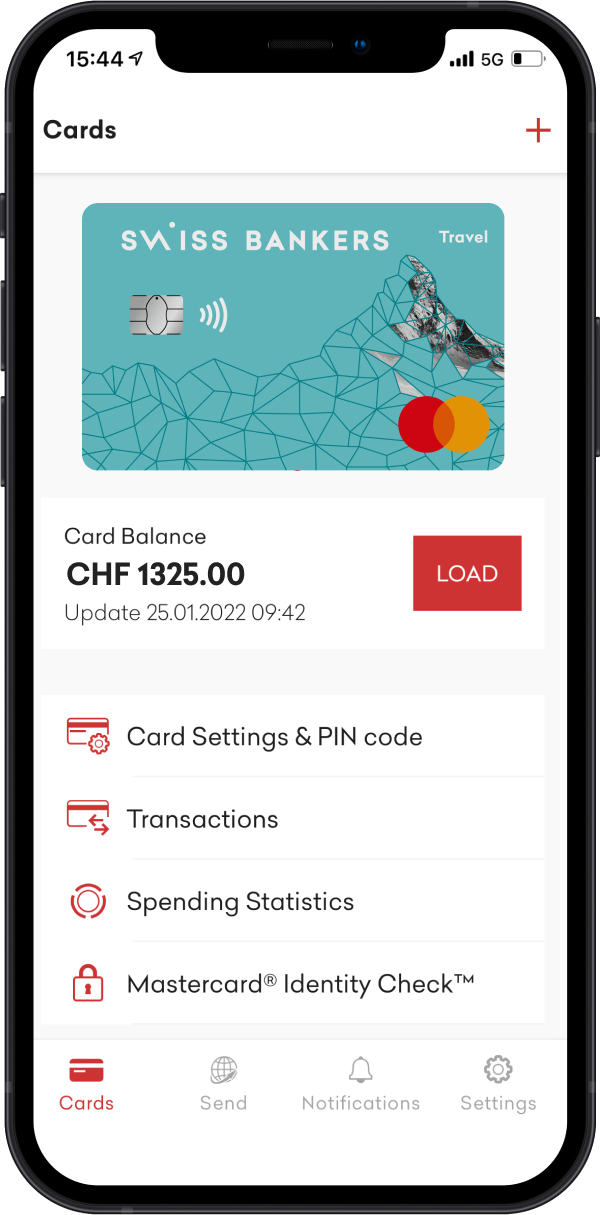

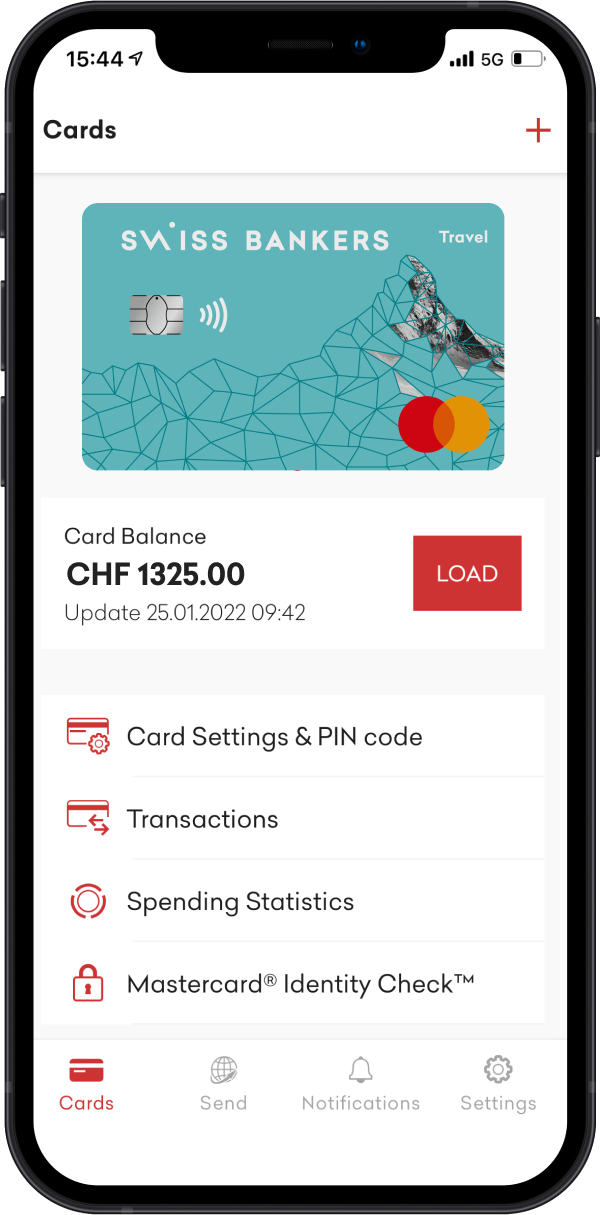

The Swiss Bankers app offers you a range of smart security features and benefits that are only available via the app.

You can also change your PIN code at any time, and enjoy peace of mind when shopping online with Mastercard Identity Check. The app also supports mobile payments (Google, Apple, Samsung, Garmin and Swatch).

You have until 13 May 2022 to top up your Travel card using the “Integrated top-up function” in e-finance, via the Hotline or at a PostFinance branch.

You can still use e-finance to top-up your card, just not via the “Integrated top-up function”. Your personal reference number will not change, meaning you will still be able to set up standing orders.

You can access your payment information in the Swiss Bankers app or in the customer portal under “Load” in the start menu. You can then select e-banking from the list of payment types. Our website also provides an overview of the various ways to top up your card. You can also check your personal reference number here.

Your Travel card gives you access to a range of Hotelcard discounts. What’s more, the CHF 99 Hotelcard membership fee is on us, every year! Simply book your accommodation at hotelcard.ch to benefit from discounts of up to 50% at more than 600 hotels.

We are happy to help in any way we can. You can find a list of frequently asked questions here.

PostFinance is no longer issuing the Travel card. What does this mean for me?

Even though PostFinance is no longer issuing the Travel card, there is still a contractual relationship between you and us (Swiss Bankers as the issuer). The terms and conditions of your Travel card do not change. Your card remains valid, and there is no restriction on the use of your card balance.

Why do I have to identify myself in the Swiss Bankers app?

As a bank, Swiss Bankers is legally required to verify the identity of customers. Since PostFinance no longer distributes the Travel card and the issuer itself, i.e. Swiss Bankers, is now the direct contact, the law requires your identity to be verified again. Data protection continues to be guaranteed.

Can I also verify my identity without the Swiss Bankers app?

No, you can only verify your identity with the Swiss Bankers app. The app also provides you with many security features and benefits that you would otherwise not be able to use. We strongly recommend that you download the app. This will protect your card and allow you to use all the functions to their full extent.

What do I have to do if I have forgotten my PIN code/Internet code?

If you have forgotten your PIN code or Internet code, contact our Customer Service at +41 31 710 12 15 (Monday to Sunday, 08.00 a.m.–10.00 p.m.). You can request a new PIN code by pressing key 5. Call up the Internet code directly by pressing key 4. If you have installed the Swiss Bankers app and registered your Travel card, you can change the PIN code there, even if you no longer know your current code.

You need the PIN code for cash withdrawals from an ATM, to pay directly in shops and when setting up your card in the Swiss Bankers app.

You need the Internet code if you want to view your card account and payment information in the customer portal.

Why is my ID card not accepted for identification?

Make sure to use a valid identification document:

Passport

Swiss ID/Swiss driving licence

European ID (Please note: European driving licences are not accepted)

Scan your ID document in a bright environment, preferably on a white surface.

What do I have to bear in mind if I have several Swiss Bankers Travel cards?

If you have several Travel cards, you only need to verify your identity once.

Add all your cards in the Swiss Bankers app so that you can keep track of them all. To add your cards, press the plus sign (+) in the top right-hand corner of the start menu.

Only register your own Travel cards in the Swiss Bankers app. If you have registered a family member’s card, for example, you must remove it under Card settings & PIN (scroll all the way down), otherwise you will not be able to complete the identification process.

How do I restart the identification (e.g. after having cancelled the process)?

Open the Swiss Bankers app and select Card settings & PIN. You will then automatically be taken to the identification screen.

How do I manage my Travel card?

You can manage your Travel card using the Swiss Bankers app. In the app, you can check the card balance, the last card transactions and other details about your card. Download the app to benefit from the security features and many useful advantages.

How can I withdraw my Travel card balance?

The card has no annual fee and costs you nothing if you don't use the card for a while. Use the card on future trips to pay or withdraw cash. We recommend that you use up the remaining balance. The card is accepted in more than 70 million shops and hotels throughout the world as well as for online payment. If lost, it will be replaced immediately worldwide free of charge by courier service.

If you wish to withdraw your balance, you have the following options:

Free repayment via Swiss Bankers app to a Swiss or Liechtenstein bank account: Press “Card Settings & PIN code” in the start menu, then “General settings” and “Close card & refund balance”.

You can use your Travel card at any cash dispenser/ATM and withdraw the balance there. Withdrawal fee CHF 5 in Switzerland/CHF 7.50 abroad.

Alternatively, you can use “Send” in the Swiss Bankers app to transfer funds to another Swiss Bankers card (max. CHF 10’000) or send money worldwide (except to Switzerland) to family and friends. More information on “Send”.

You can also use the form for card balance refunds. Please note that a fee of CHF / EUR / USD 20 is charged for processing the refund of card balances above CHF / EUR / USD 50. The payout may take several weeks: Download form

Please destroy your card if you no longer wish to use it. Your card will not be renewed automatically.

Couldn’t find the answer to your question? Get in touch with us and we will review your query.

Customer service:

+41 31 710 12

34 (Monday to Friday, 08.00 a.m.–06.00 p.m.)

Call our hotline